We develop green energy projects that power-up communities and industries. By making a meaningful contribution to the renewable energy transition across Europe, we are increasing the energy-driven competitiveness of the European economy and safeguarding the environment. All of our activities are framed by strong ethics and best practices around environmental, social and governance principles. We act transparently with all of our stakeholders and expect the same in return. Galileo was founded in 2020 when Ingmar Wilhelm and HRL Morrison & Co. joined forces to create a new renewable energies platform. Before launch, our management team already had a proven track record of developing highly successful renewable energy businesses, pipelines of various renewable energy technologies and off-take solutions worldwide. And now, with transparent, professional and long-term investor backing, we are growing at pace as a pan-European, multi-technology, renewable energy developer, owner, and operator.

Infratil is an infrastructure investment company focused on assets across the renewables, digital, healthcare and airport sectors. The company is listed on the New Zealand and Australian stock exchanges (NZX, IFT.ASX).

CSC looks after superannuation (pension) funds designed specifically for Australian Government and Defence Force employees. CSC has over AUD 70bn (Dec-24) invested in high quality private and public assets including wind farms and renewable energy initiatives that add to the net new supply of energy transition assets.

The New Zealand Super Fund is an NZD 80.3bn (Dec-24) sovereign wealth fund established by the New Zealand Government to partially pre-fund the future cost of universal pension payments. The Fund is managed by the Guardians of New Zealand Superannuation, a Crown entity.

MGIFER is managed by Morrison, a leading global infrastructure manager, with over USD 28bn of AUM (Mar-25). Morrison is a privately held investment firm founded in 1988 as a specialist alternative investment manager, and has been investing in infrastructure, for over three decades. Investment management strategy focused on “ideas that matter”, with a diversified sector approach based on strong secular trends shaping future essential services and societal needs.

Galileo was founded in 2020 when Ingmar Wilhelm and HRL Morrison & Co. joined forces to create a new renewable energies platform. Before launch, our management team already had a proven track record of developing highly successful renewable energy businesses, pipelines of various renewable energy technologies and off-take solutions worldwide. And now, with transparent, professional and long-term investor backing, we are growing at pace as a pan-European, multi-technology, renewable energy developer, owner, and operator.

Our long-term investors:

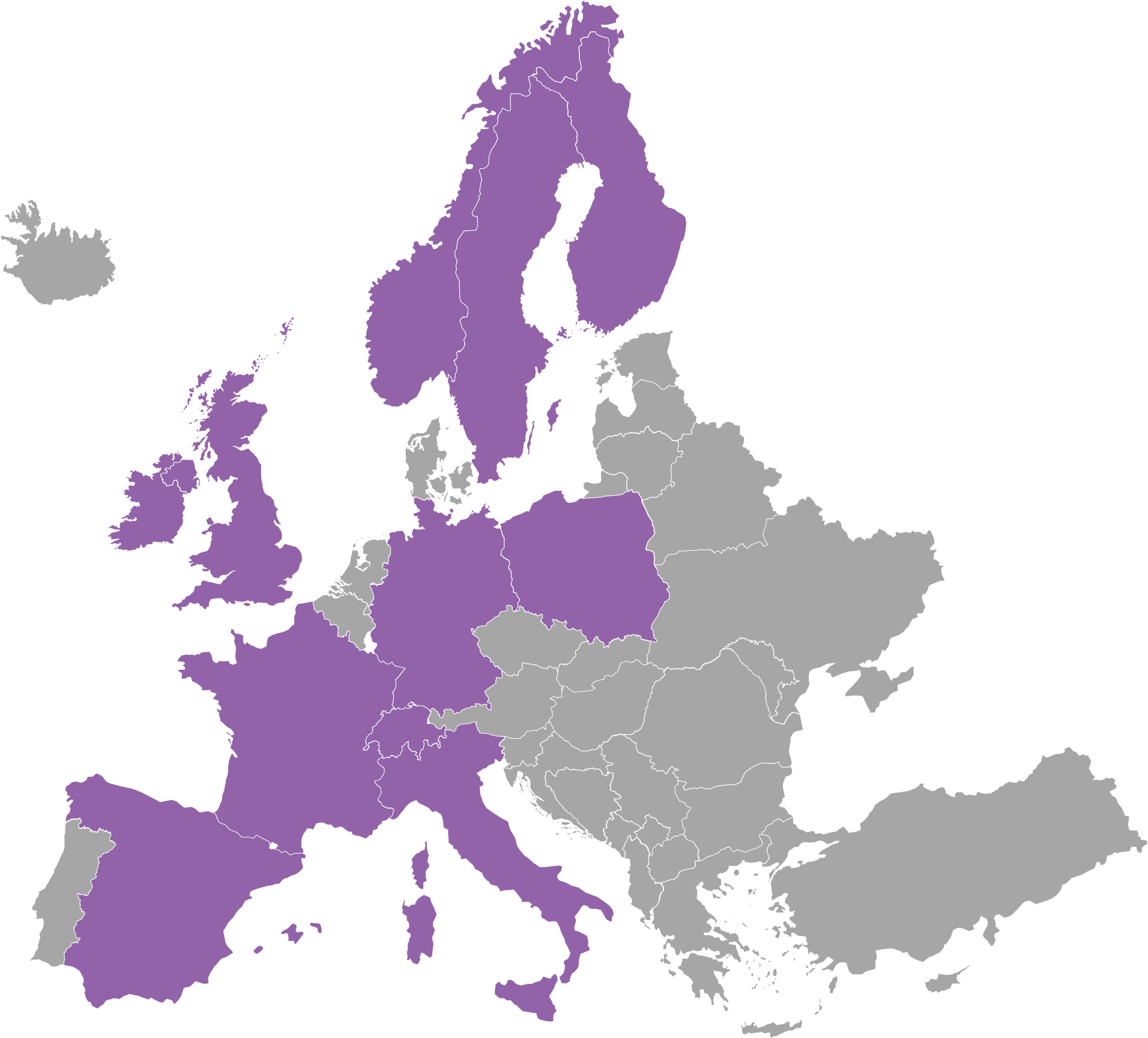

We actively develop large-scale renewable energy projects in multiple European countries, including Finland, France, Germany, Ireland, Italy, Norway, Poland, Spain, Sweden and UK. Our geographical footprint continues to grow through the extension of our greenfield development teams and long-term development partnerships.

Trying new ideas and taking responsibility

Adapting quickly from a stable foundation

Working together with empathy and compromise

Enabling the right people to make the right decision

With our colleagues, partners and stakeholders